One of the main reasons there are so few prosecutions for police corruption, brutality, and other crimes is because the police investigate the police. If anyone wants to argue that police officers are more or less corrupt than either bankers or politicians, let him do so in another forum. The lecture delivered by this high flying financier can be found in audio form here for the moment, and the text can be found here. Mr Diamond begins with a self-effacing comment, ie that banks are not or have not been perceived as good citizens, but they can be.

This is of course a reference to the recent and ongoing financial collapse, but rather than being any sort of magnanimous admission, the author is simply stating the obvious; had he not made that concession, his lecture/speech/propaganda exercise, would have had no credibility at all.

The people at Positive Money have commented on Mr Diamond’s waffle with their usual restraint; Ben Dyson said simply that he is peddling a fairy tale. If that sounds innocuous, it should be borne in mind that it was a fairy tale that led to the invasion of Iraq and everything that came with it.

His next claim is that the single most important thing for banks and for businesses now is to focus on helping to create jobs and economic growth. There can be no doubt that when he says that he means it, because it is the prevailing economic wisdom, and has been certainly for the past hundred years if not longer, but is job creation necessary? In a word, no. Is economic growth necessary, or to put it another way, can we have prosperity without growth?

The reality is that in the West, the so-called advanced nations, and also in Japan, South Korea, etc, the problem is not to create jobs, certainly not jobs at any price, but to distribute income. The two are entirely different concepts. As discussed in earlier articles – here and here – in the technologically driven, service oriented economies of the future, there will be less and less work for willing hands, and some people will be, and already are, essentially unemployable, that is, they are unable to earn a living wage by the sweat of their brow.

If we want to create employment, there are two guaranteed ways. The first is we can do what the Luddites did, smash up machinery. Think of how the post office would benefit if there were no more e-mail! The second proposition is to start a war, as advocated by Gilbert Frankau. And the bloodier and more extensive, the better. How about a world war fought with conventional weapons?

If the reader thinks either of those suggestions sounds frivolous, he should bear in mind that the Luddites did break machinery, and Gilbert Frankau’s ludicrous claim is a matter of historical record. Now let us look again at the real problem, how do we distribute income without wages and salaries? The answer has three readily recognisable names to students of real economics: Social Credit – the original; National Dividend; and what has become the preferred term, Basic Income.

One person who has a Basic Income already is our multi-millionaire Prime Minister, Call Me Dave. Like the multi-talented Paul McCartney, the not so multi-talented David Cameron isn’t in it for the money, but what they both have is unearned income. It is taken for granted by all mainstream economists, politicians and bankers that people who invest large sums of money should receive interest on it. Herein, lies the problem.

“We stand today at the end of a long cycle of excess borrowing – borrowing by financial institutions, by governments, by consumers, and by businesses.”

Everybody it seems is borrowing, everybody is in debt. Which begs the question, if absolutely everybody is in debt, who are the creditors? The reality is that governments do not have to borrow, a sovereign government has the sovereign right to create its own credit. Ah, but you can’t just print money, they say, that will cause inflation. What they – meaning Bob Diamond, David Cameron and his Chancellor et al – forget is that we have inflation anyway. When governments borrow money, they have to repay this money with interest. If everybody in the world has to repay loans with interest, certainly every government, there will come a point when it will be impossible for all to repay. That time has in fact come and gone long ago, and leading financial institutions have created all manner of schemes and cons to to part the suckers from their money, like the derivatives market.

Regarding Greece, the European country that has suffered most recently from the tyranny of finance, he says “The solution has to include a reduction in public spending.”

The deficit was an unsustainable 150% of GDP, and has to be reduced because it is too big to manage by taxes alone; in the US and UK, the ratios are 100% and 83% respectively.

“Ten years ago those ratios would have been roughly half that.”

And they are now so high because of...tell them, Bob, because these countries, including the mighty American empire, the world’s policeman, the Great Satan, are paying interest on debts whipped up out of thin air so that the smiling Mr Diamond and his ilk can jet around the world in their $950 Austin Reed suits staying at £600 a night hotels like a certain Mr Strauss-Kahn while they advise policy makers, White House staffers, even Presidents how to slash their deficits by closing libraries, sacking hospital staff, squeezing student loans in order for them and their fellow bankers to be construed as good citizens.

Now we come to the principal objection of Ben Dyson and his crew:

“Banks hold deposits and savings entrusted to them by individuals, by businesses, by governments and by central banks.

They put that money to work, helping people to buy homes for example or lending to businesses to invest in expansion.”

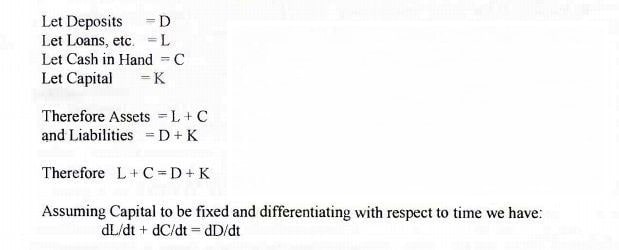

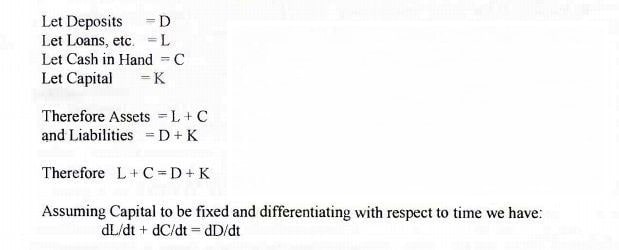

No squire, they do not, as you well know. The Douglas Money Equation (below) is proof positive of that.

Mr Diamond would have his audience believe that when a bank advances a loan, it takes money from a saver’s account and deposits it in a borrower’s account, or that it takes money from fixed reserves. What actually happens is if for argument’s sake Joe Sixpack borrows $1000, Mr Diamond simply credits his account with $1000 and his loan account with $1000. If now, Joe blows his wad on cocaine and in the process gets busted for possession with intent to supply, and is sent down for 15 years, Mr Diamond simply (and very quietly) writes off the loan.

Contrast this with what happens if Joe borrows this money from his next door neighbour, or a venture capitalist. The lender loses $1000, period. This is why venture capitalists and others who lend real money charge – and are entitled to – heavier rates of interest than banks, because unlike Mr Diamond, they are taking a real risk.

While it is true the banks came a cropper during the crash, they soon got out of it, they simply leaned on the governments of the world – including and especially Britain and America 7ndash; and our governments bailed them out without any consultation with us.

It’s no surprise then that the UK Government is reducing public spending in order to avoid higher costs of borrowing, he says, “As a result, the UK can still borrow at a rate of 2.5% while Italy, Spain Portugal and Ireland have to pay between 6% and 12%.

Think about this. This is simplified, but it’s important. If the UK government had to pay 6% interest on its current outstanding debt, it would cost all of us in the UK another £40 billion a year.

That’s about half the annual budget for the National Health Service.”

Yes, and think about this, if the UK Government paid 0% interest and 0% on money it created itself, it wouldn’t have to (re)pay anything, and you would be out of a job. Now answer this, Mr $950 suit, if you can create the money as figures in a book and charge the government for it, why can’t the government do the same for free?

Ah, but that would cause inflation, comes that well worn mantra. That’s not what Ben Dyson and co say, and more and more people are waking up to the truth.

Mr Diamond also has something to say about pension funds which need “returns on their investments of about 7% in order to honour their liabilities; in other words to pay savers their pensions.”

What he neglects to mention are the massive fees these funds charge –

A 2% set up charge doesn’t sound much, and a 1.5% annual management charge sounds positively modest, but check out this article and the link to the Panorama programme, then think again. The big advantage of a pension fund, indeed the only real advantage, is the associated tax break, but if pensioners and other savers are also paying massive fees, bonuses and commissions to the people who “manage” their funds, this is a case of roundabouts and swings. They would be much better off managing their own portfolios, as some people do.

There is more to Mr Diamond’s speech, more of the same. There is no doubt he does mean well, but his first priority is to prop up the debt-based money system. If your children starve in the meantime, or if public services in Greece, Italy, Britain, the USA, the whole world, are stripped to the bone, he will shed a tear for you, but he will still travel the world dressed in his $950 suit whispering in the ears of treasurers, presidents and kings.

[The above op-ed was first published November 10, 2011.]

Return To Site Index