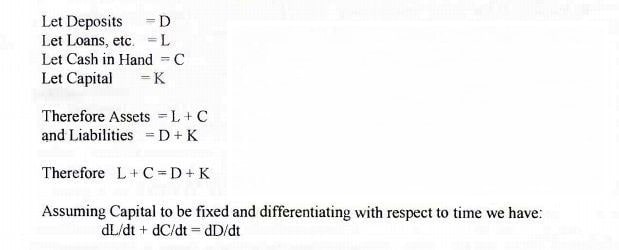

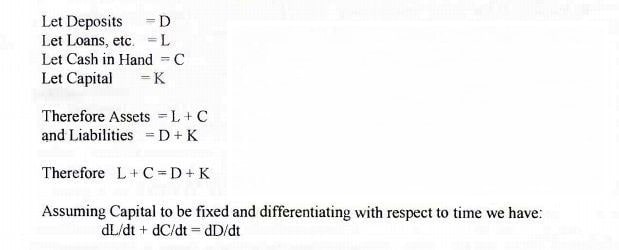

This is the “Douglas Money Equation” as formulated by Major C.H. Douglas (1879-1952).

The following are offered by this Internet Iconoclast to dispel your ignorance and help you think the way you should, rather than the way our masters want you to think. Read, learn, inwardly digest, and where indicated, follow the links.

1) Banks lend the money of their depositors

This is the big one, and nobody believes it anymore. Major Douglas proved it is not so with his famous equation (below), but briefly what happens is this: people, companies and so on, deposit money with a bank. When the bank makes a loan, it creates an entry in the ledger, say £5,000 to the credit of Mr A. When Mr A. withdraws this money, and he – or somebody – pays it into another bank account, this action increases the money supply. This newly created money has come into existence purely by dint of that entry by the bank. Assuming Mr A. repays his bank loan, as he does so, the new money is cancelled out of existence, leaving only the interest on the loan, which is not only new money but new debt.

This process can be summed up in the phrase:

Every bank loan creates a deposit; every repayment of a loan destroys a deposit.

This is the “Douglas Money Equation” as formulated by Major C.H. Douglas (1879-1952).

2) Printing money causes inflation

There are different types of inflation and different causes of it, but the idea that simply printing money causes inflation is a crass oversimplification. Consider this by way of analogy. If you were thirsty and were denied water – for whatever reason – this could kill you. If you drank a little wine or beer, that would quench your thirst, but by the same token, it is possible to drink yourself to death in a relatively short period of time; this is known as alcohol poisoning.

Likewise, it is possible to print too much money; it is also possible to print too little. Printing in this sense can mean not simply printing but increasing the money supply by other means, often electronically. Indeed, most of the money in circulation exists only as credit, it has no tangible existence and is simply figures in a book or more often nowadays blips in cyberspace.

Society needs money in order to facilitate the exchange of goods and services. In primitive societies, barter was nowhere near as inconvenient as it is today. If you wanted a fur coat and could offer the tailor eggs, chickens or whatever in exchange, that was probably not too much of a problem. When you want to purchase a week’s groceries, fill up your car and fit smoke alarms in your new house, barter is off the menu. Money was invented to solve this problem. As the goods and services the community produces increase, the money supply must of necessity increase too. If there is not enough money, people can’t afford to trade. If money is issued out of all proportion to the available goods and services, inflation or in extreme cases hyperinflation can result.

Central banks (the Bank of England here) are responsible for the issue of money. The Bank of England says it is committed to keeping inflation at 2%. The fact that it is unable to do this indicates that the people running it don’t have a clue how to run an economy, much less how to control inflation.

3) Quantitative Easing is printing money electronically

Like the above, this is a simplification. Here is a discussion of how it is actually done, and of what is actually done, but the bottom line is that when a government engages in QE, it creates not new money but new debt. This new money is then given to the banks, and these institutions are free to lend it (ie sell it at interest) at their caprice. If that sounds like a bad idea to you, it doesn’t to the banks.

4) Hard work is good

When he was Prime Minister, Gordon Brown often alluded to “hard working families”; Call Me Dave echoes these sentiments, but what is so great about hard work? The 1847 Factory Act reduced the working day for under 18s and women to 10 hours. If you think that is some sort of sick joke, try looking at the earlier acts. If hard work is good, perhaps sweated labour is better. How about slavery? Anybody agree with those propositions?

Hard work for the sake of it is not only of absolutely no merit, it is detrimental to our health and probably to our mental health as well. A burglar can work hard, and many do.

5) Unemployment is a bad thing

As might be expected, the same people who believe hard work is good believe unemployment is bad. Major Douglas would beg to differ. In fact, strictly speaking there is no such thing as unemployment or the unemployed. How many unemployed billionaires are there? It is more accurate to say there are people without livelihood. The idea that people must have the right to earn their livelihoods is a philosophical or more accurately pseudo-moral concept, and has no place in economics.

6) We live by our exports

The more we export, the harder we have to work. Hard work is bad – see above. The only reason we should export is to trade goods it benefits us to make but don’t need for goods we want but it benefits us not to make. It is possible to grow bananas in Britain – at Kew Gardens, under glass elsewhere and indeed in the open. All the same, we are better off importing bananas from the Winward Islands. Trade should mean swapping goods and/or services of equal value, of course, if foreigners want to give us goods and/or services in return for bits of paper, why should we not oblige?

7) Monopolies are bad

Yes and no. In practice, the only way a monopoly can be enforced is by legislation to keep out or restrict the competition. Don’t take my word for it, listen to Murray Rothbard. Competition can be restricted in any number of ways, and again listen to Rothbard for a more detailed explanation, but one way is by the imposition of tariffs. The mirror image of tariffs is subsidies. In his 1975 book Ninety-Five Per Cent is Crap: A Plain Man’s Guide to British Politics, Libertarian Terry Arthur points out “The topography of the Common Market now consists largely of butter mountains, beef mountains, and wine lakes!”

Subsidies are not always and only detrimental to the economy. A big subsidy of a particular product would allow economies of scale that could reduce the price and lead to other benefits, but most subsidies aren’t effected for the public good, rather they come about by lobbying on behalf of vested interests, usually in the name of the public good.

8) Small is beautiful

While it is true that businessmen hate competition and prefer to form cartels to raise profits and prices (and keep out new competitors), ultimately this can be effected only by legislation – again, see Rothbard as per above. It is not true however that big companies are undesirable or even evil per se. The charity War On Want has been peddling this belief for some time, but the truth is that some goods and services can be supplied at affordable prices due only to the economies of scale that a big company can deliver.

A particularly tragic illustration of this happened in Rhodesia. After this once prosperous country was turned over to mass murderer Robert Mugabe, white farmers were evicted from their properties, indeed many of them were murdered. Seeing only racist oppression by these wicked capitalists, the Mugabe régime set about the Africanisation of their land, ie splitting it up for small farmers. And the result was?

It never occurred to Mugabe that racist or not, these farmers might just have known what they were doing, nor that a one thousand acre farm is considerably more efficient than a thousand one acre smallholdings.

9) We need austerity

This is topical, and although our governments and their masters (and mistress) are intent on imposing it on us, there is growing resistance to it.

The wealth of nations is determined by the goods and services their people can produce. A billionaire stranded on a desert island without resources would starve. Cutting the production of goods and services ndash; public and/or private – destroys wealth of necessity.

The banksters and their political frontmen want nation states – Greece and others – to service their debts. These debts have been created out of thin air – see 1) above. In practice this can’t be done, at least not for any period of time, because there is more debt in the world than money.

Back in the 1940s, the Duke of Bedford proposed a simple solution to the problem of the national debt, one which can be applied to all nations. The reason this will not be applied at the present time is because the banks have what Major Douglas called the monopoly of credit; they have effected this in Europe by the imposition of the Treaty of Maastricht.

The way out of austerity is for our governments to withdraw from or simply to dump this perfidious piece of financial bondage and print their own money. During war times, governments make use of cheap credit. No country ever lost a war because it ran out of money.

If all governments issued their own money responsibly, there would be no or extremely little public debt, and they would be able to meet their responsibilities towards all their citizens.

[The above blog was first published October 16, 2012.]

Return To Site Index