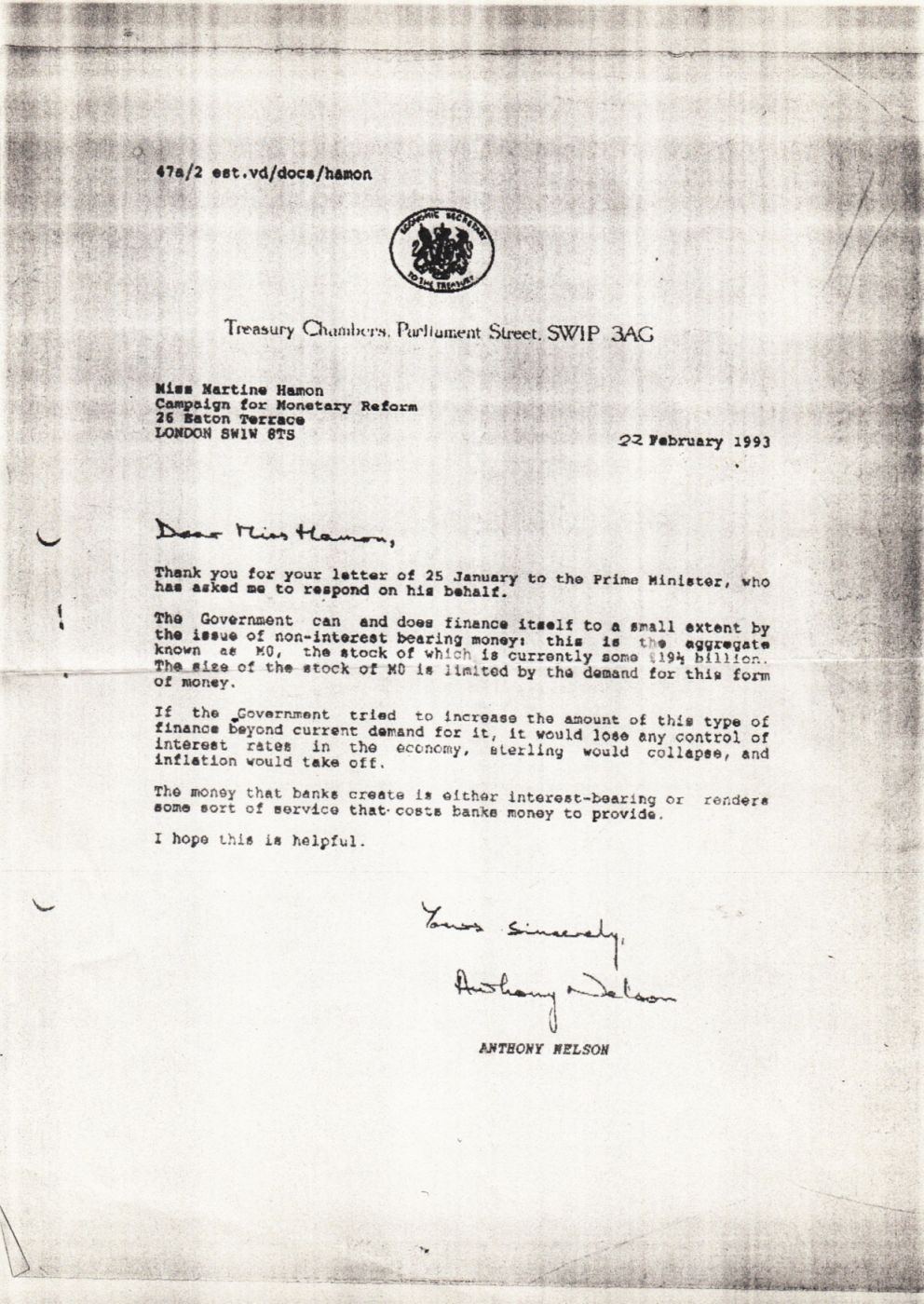

The letter below has been in my possession for some considerable time. I thought it came from Sabine McNeill, but she has denied any knowledge of it, so I can assume only that it came from a CCMJ contact or perhaps I picked it up at one of the meetings I attended at Westminster.

Although I have not seen the original letter from Martine Hamon, it is clear what it concerns; it is also clear how she has been fobbed off by this former merchant banker and so-called research analyst, not to mention Harrow School alumnus. Briefly, he concedes that the government does indeed finance spending to a limited extent by M0, principally the coin and note issue. The cost of so doing is limited to the cost of printing and minting, security, etc. The size of M0 is limited to the demand for it. Indeed! Clearly demand for money can be infinite, as of anything else, but just as clearly there is a shortage in the economy, because people ain’t got none!

The third paragraph presupposes that the British Government or any government should set or attempt to set interest rates. The claim that sterling would collapse and inflation would take off (he implies hyper-inflation) is absolute bunk.

The fourth paragraph contributes nothing. Obviously banks cost money to run, but this is a bookkeeping and strong-rooming service, in addition to things like currency exchange, etc. He does not explain why banks must lend (ie sell at interest) this credit they create ex nihilo. Nor why the Government cannot do so debt-free/interest free.

Obviously if any government simply issues money with nothing backing it then the currency will inflate, but provided credit is created responsibly this need not happen. One way to do this is by investing this new money directly in infrastructure, new technologies, etc. And by paying a Basic Income to those who don’t have enough of the stuff, [see entries on the Site Index page]. Even if some inflation did result, this would be more than off-set in other ways. In particular the rate of taxation could be reduced drastically, and in many cases abolished altogether.

Return To Site Index