Recently I was told by a correspondent that printing money causes inflation. This guy is no mug, for one thing he is active in local politics, but he is far from the only highly educated person to be duped by this oft’ repeated fallacy. To refute it, let’s do a little thought experiment.

At the time of Christ (whether or not he actually existed), the population of the Earth is estimated to have been from 200 to 300 million. Although civilisation existed in the Middle East, Rome, Greece and elsewhere, there was little in the way of material goods, certainly no computers, mobile phones or even books in the proper sense of the word, and travel was limited to the speed of a horse.

At the time of William Shakespeare, world population was between about 450 and 600 million, not a massive increase. Not a lot had changed technologically, at least as far as we would recognise it, but the printing press had been invented, which meant a certain demand for books. By this time too, banknotes were in use, so we may ask the question, was there more money in circulation than at the time of Christ? The fact that there were more people: more mouths to feed, more and better buildings – including churches, castles, etc, more goods and more consumers, leads one to believe there must have been more money too.

Now let us leap forward to the present, December 1, 2012 to be precise. We have a world population of around 7 billion, and far more infrastructure, goods and services than at any time in history. To take just one tiny example, in September last year, Ford sold 15,647 of its Fiesta model in Britain. That is one make of car by one manufacturer to one small island nation. That’s without vans, lorries, trams, trains, aircraft...Now here is a simple question, if the amount of money in the world had not increased since the time of Christ or even since the time of Shakespeare, what would have happened to the world economy?

More goods and services, more infrastructure...requires more money. The money supply must increase, or else.

One of my favourite quotes:

“Does he, and do his colleagues, realise that half a dozen men at the top of the five big banks could upset the whole fabric of Government finance by refraining from renewing Treasury bills?”

That is from 1921.

There are two big questions relating to the above:

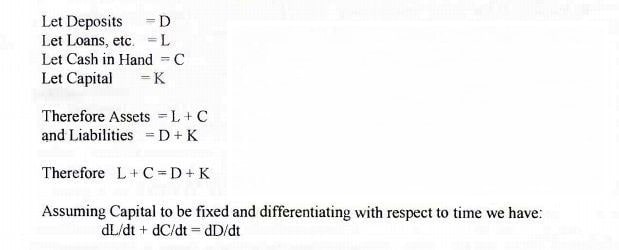

A) By how much is the money supply to be increased?

B) How is it to be increased?

Nowadays, most money exists as figures in a book or blips in cyberspace (don’t confuse this sort of credit with the live-now-pay-later type of credit). Clearly, it is extremely easy to create credit at no cost, even easier than to print, print and print money; both lead to inflation. There are many causes of rising prices, but the greatest cause of inflation is printing money or creating it electronically capriciously.

Therefore, new money should be created – by the government and only by the government – and spent into circulation; if the government does this scientifically, or even cautiously, there is no need at all for prices to increase catastrophically. But, and it’s a big but, the government must do so debt-free, and it must not permit private banks to create credit.

This does not mean that people can’t trade locally through LETS schemes, barter and such. But aren’t local currencies money? Yes and no. Money can be any medium at all; there is no reason why two companies or even two individuals can’t trade with each using their own currency, but money in the sense in which the word is used above means something which is not only acceptable but obligatory.

If the government keeps a firm grip on the nation’s money supply and issues it debt-free, the problem of inflation and indeed of debt will be solved.

It must also eliminate speculation for the sake of speculation, such as that engaged in by Kweku Adoboli and his former employers. Adoboli was called a trader, in fact he was a speculator, a gambler pure and simple, but once the power of credit creation is taken away from the banks, most of this rampant speculation will disappear. Making these people personally liable for any loses they run up and giving genuine investors a bigger say in how their money is thrown around will also curtail their greed, and put and end to the bust at the end of every boom.

[The above article was first published as a blog on Digital Journal, December 1, 2012.]

Return To Site Index