Way back in the 1880s, the American populist Mrs Sarah Emery published Seven Financial Conspiracies Which Have Enslaved the American People. A century later this book would be branded anti-Semitic, even though the word Jew does not appear once in its text.

Others who have exposed the system have been likewise denounced as bigots, cranks, nutters, and so on, including the great Major Douglas (pictured above), who was described as an inflationist crank who promoted the “mumbo jumbo of the A+B theorem”.

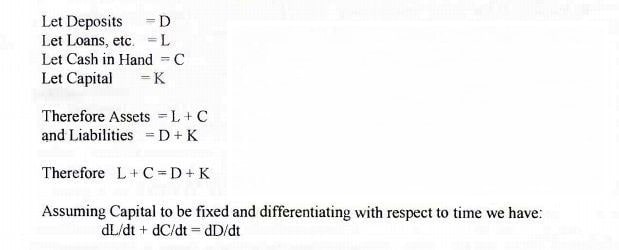

Up until fairly recently it was denied that banks created money, in spite of the mathematical proof proffered by Douglas, and in spite of this being quietly admitted in standard works on economics.

This is the “Douglas Money Equation” as formulated by Major C.H. Douglas (1879-1952).

Now, the supposedly so mysterious process of quantitative easing is discussed openly in the mainstream media. Vince Cable and others haven’t yet worked out how the banks are allowed to do this while the governments of the world are not, but give them time.

In London, so-called trader Kweku Adoboli was given a seven year sentence for fraud; he was said to have gambled away nearly a billion and a half pounds. The simple fact though is that he did what others of his kind do all the time. These so-called traders don’t trade, they gamble; so-called investment banks don’t invest, they do likewise.

If you want proof of this, check out these two short videos with particular reference to the admissions they make. The first one sees an investment fund manager pointing out what should be self-evident with a little insight, that most so-called investment managers don’t outperform the market, and that the people who make the biggest gains are those who buy stocks and hold them, ie don’t gamble.

The second video contains some interesting information about so-called hedge funds, the astronomical fees they charge their wealthy clients, and what they actually do.

Kweku Adoboli, the City trader given a seven year sentence for doing what his kind do the world over every day.

The loonies of the left blame this on capitalism, but the truth is it has absolutely nothing to do with capitalism. Big companies like the supermarket chains, and the strangely despised Google produce enormous wealth and service consumers, making all our lives easier and richer. Banks, on the other hand, shuffle around bits of paper, and have been stealing the Earth by this process for generations. As one pundit put it, it has been socialism for the banks and capitalism for everyone else: governments, corporations, businesses and us little people. When the banks overstepped the mark, the British, US and other governments intervened to bail them out, and it’s us who are told we must pick up the tab, it is us who must suffer austerity. But maybe not for much longer.

The scam may be the straw that broke the camel’s back, and as 2012 saw the veil lifted from the eyes of the people and politicians alike (those who are not in the banks’ pockets), so we can only hope that 2013 leads to the politicians and the people stripping the banks of their power, and putting especially the creation of credit where it belongs: in Britain, with the Crown; in the US with Congress; in other countries, with their democratically elected and accountable governments.

[The above op-ed was first published January 1, 2013.]

Return To Site Index